COVID-19 and Business Confidence in BD, survey findings revealed

COVID-19 and Business Confidence in BD, survey findings revealed

|

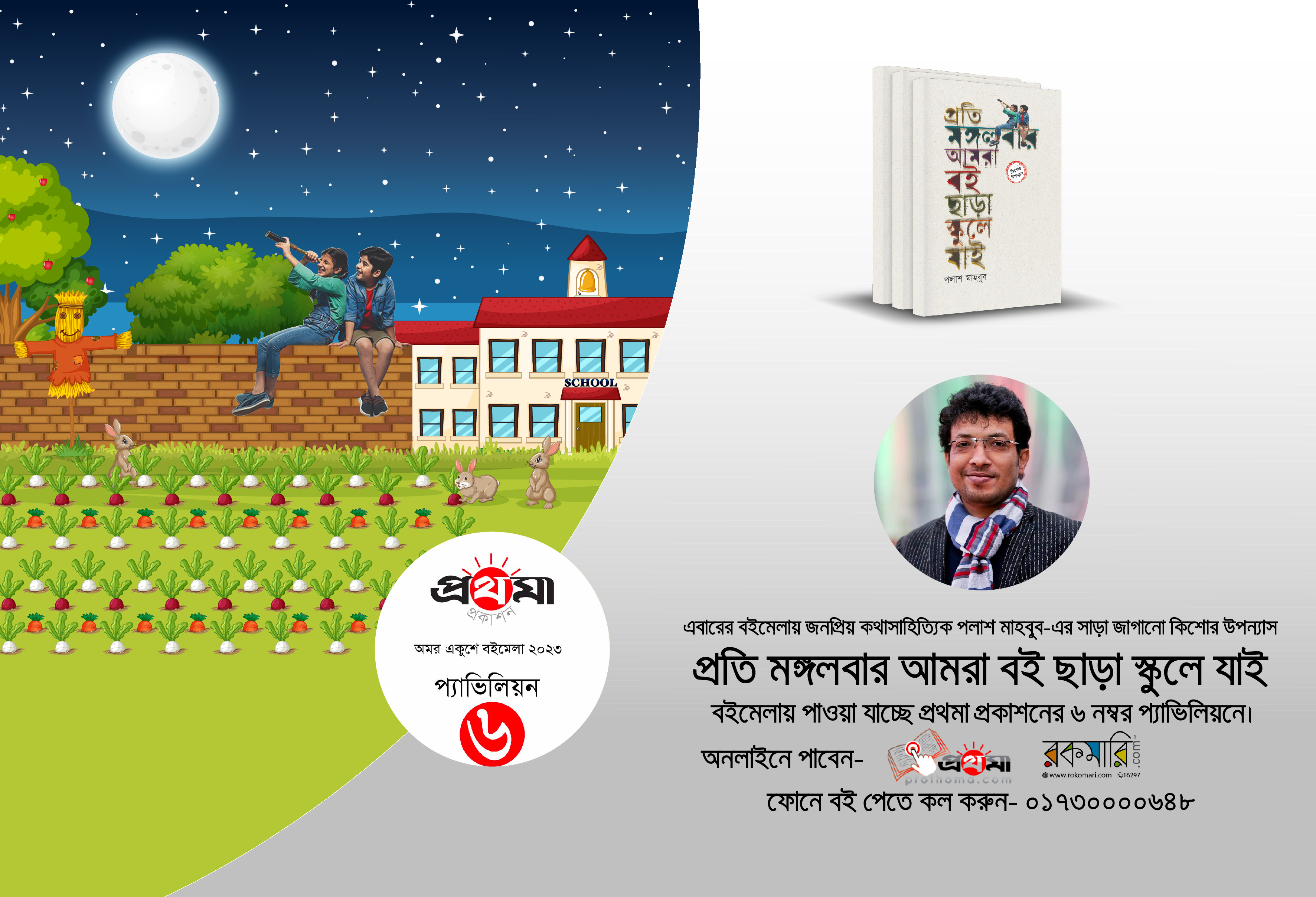

On the 16th of February, Tuesday South Asian Network of Economic Modeling (SANEM) in collaboration with The Asia Foundation presented the results from the third round of a nationwide firm-level survey. The survey conducted over the month of January, were disclosed through a webinar which was moderated by Dr Selim Raihan, Professor of Economics, Dhaka University, and Executive Director of SANEM. The event was graced by eminent business personalities including Asif Ibrahim, Chairman, Chittagong Stock Exchange; Abul Kasem Khan, Managing Director, A.K. Khan Telecom Limited; Arshad Jamal, Vice President, Bangladesh Garment Manufacturers and Exporters Association (BGMEA); Md. Saiful Islam, President, Leathergoods & Footwear Manufacturers and Exporters Association of Bangladesh (LFMEAB); and Farzana Khan, General Manager, SME Foundation.

The first round of the survey (held in July '20) revealed the urgent state of business in the country. The second round (conducted in October '20) showed signs of economic recovery. The third round of the survey was conducted in January 2021. This round of survey provides an opportunity for a better understanding of the economy's pulse as the COVID situation unfolds. The main objective of this ongoing project is to assess the impact of the COVID-19 crisis on business confidence and outlook in Bangladesh.

In total, 502 firms were surveyed consisting of 252 manufacturing firms and 250 service-oriented firms. Firms were asked to express their opinion on six key issues: profitability, investment, employment, wage, business cost, and sales/exports. Survey responses were based on comparisons of the present situation with that of the previous quarter and previous year and scored as follows: 0 indicates much worse, 25 indicates worse, 50 indicates no change, 75 indicates better and 100 indicates much better. Based on the responses, three indices were calculated: Present Business Status Index (Year), which compared performance over October-December 2020 with that over the same quarter last year, Present Business Status Index (Quarter), which compared performance over October-December 2020 with that over July-September 2020, and Business Confidence Index (Next Quarter) which compares expectations regarding the performance in January-March 2021 with that over the present quarter (October-December 2020). Across the three indices, a score of 50 indicates no change in the status, a score of less than 50 indicates deterioration while that above 50 indicates an improvement in business status/confidence.

Dr Selim Raihan opened the discussion by highlighting the importance of private sector confidence in economic recovery and its implications on effective policy formulation. The key findings are summarized below:

• The first round of surveys was conducted in April-June 2020, second round in July-September 2020 and third round in October-December 2020. The yearly PBSI shows that there is progress. The first round score was 26.44, 34.23 in the second round, which improved to 36.50 in the third round. While there has been significant improvement from the first to second round, the progress has been marginal from the second to third. Particularly, compared to the past year, business costs have risen.

• From the immediate past quarter's perspective, there have been significant improvement from the first to second rounds but a marginal improvement from second to the third, i.e. the overall PBSI index rose from 47.96 to 48.83. On a quarterly basis too, situation of business costs has worsened.

• On a yearly basis, RMG, leather, pharmaceuticals and ICT are observed to experience deteriorating business confidence while there have been marginal improvements on a quarterly basis for sectors such as RMG, Textile, Leather, Pharmaceuticals and Transport.

• Comparison of PBSIs of 2nd and 3rd rounds show that the condition of leather, food processing, real estate has deteriorated while that of RMG is slightly better

• The confidence of businesses for the next quarter as represented by Business Confidence Index (BCI) has improved, but progress has slowed down from the second to third round. The improvement is particularly negligible for sales and export

• Analysis of sectoral BCI shows that for the current quarter BCI is lower than the overall figures for RMG, Textile, Leather, Food, Light engineering, Wholesale, Transport, Real estate and other services

• Enabling Business-Environment Index (EBI) has deteriorated from the index falling from 45.19 in the first round to 43.39 in the third round. There has been deterioration in overall tax system, business or property registration, transport quality, trade logistics and access to finance. However, there has been slight improvement on indicators like corruption, government support for industry and COVID-19 management. There have been sectoral level variations as well. With respect to the EBI, large firms are better off, while small and micro firms fared worse.

• In the third round, 16 percent of businesses expected a strong economic recovery as opposed to only 4 percent in the second round. 17 percent of micro and small firms expect strong recovery compared to only 3 percent in the second round. Present business status of firms expecting a recovery are better than those not expecting.

• In the third round, 22 percent of firms received stimulus package compared to 19 percent in the second round. Among the overall recipients, 59 percent of RMG firms received the package while those from restaurants and other services did not receive. From the second to third rounds, micro and small firm recipients increased from 8 percent to 10 percent while medium firms increased from 20 percent to 28 percent.

• Recipients of the packages faced problems due to lengthy procedure, difficulty in bank services and procedural application systems. Those who did not receive said that incentive package is not a grant, no package for industry, procedural and bank related difficulties. Whereas the EBI for all firms is 43.4, the index is 47.5 for recipients meaning the packages have helped the businesses overcome the difficult business situations.

• The gap between expectation and reality has been observed to narrow. While the mean ratio in the first round was 2.07 it fell to 1.25 and 1.22 in the second and third respectively. This indicates that high expectation of next quarters is not revealed and businesses are more aware of real situations.

Asif Ibrahim mentioned that the pandemic has largely affected business profitability and costs. Moreover, the second wave is yet a concern for survival and cash flow management amid the order cancellations and repayments related to the government stimulus package. He mentioned that large firms have performed better than the smaller firms since they have better access to finance and easier bank-client relationship. He focused on private sector consultations in case of new policy adoptions, monetary and fiscal policies to target more investment with the aim of job creation and the channelling to stimulus packages to small and medium firms.

Farzana Khan highlighted the importance of survival of businesses which was a key priority for the SMEs in the crisis period. Although several SME operating entrepreneurs were struggling to survive, employees were not laid off and a basic salary was being provided. Nonetheless, many new entrepreneurs have emerged in the crisis period and there has been a trend of product diversification. For example, a plastic product business has now shifted to the manufacture and export of masks. She further highlighted the issue of being unaware of the available incentive package and that ICT should be developed which is one of the vital facilitators of boosting SME businesses.

Abul Kasem Khan highlighted that the tax system is a major bottleneck for Bangladesh. The at-source tax does not allow for any adjustment and refund causing SMEs to suffer. Thus, along with a tax framing regime, improved access to finance, incorporation of trade licenses in the banking system will help to create an enabling business environment. Also, the crisis mandates consumption to be incentivized in order to create demand.

Arshad Jamal informed that small and medium sized enterprises in the RMG sector are at greater risks since lower-risk factories receive more number of orders. He mentioned that it is essential to quantify indicators for expectations and reality for government to internalize as well as the resilience as to the reasons behind our confidence. Also, he suggested that productivity, energy and financial management are required.

Md. Saiful Islam, President, Leathergoods & Footwear Manufacturers and Exporters Association of Bangladesh (LFMEAB) highlighted that export volume has increased at the cost of profitability caused by lower unit prices and higher cost of sales. This has further led to sustainability, access to finance and bank-client relationship being at risk. The government should already consider the design of policy support through innovation and enhanced productivity for the 10 percent tax that will be implemented after graduation.

The webinar was concluded with closing remarks from Dr Selim Raihan who expressed his gratitude towards all panelists and SANEM's continued efforts. Finally, he thanked all and expressed hope that the survey results would be useful in making policy decisions.

আরও পড়ুন

জনপ্রিয়

- Harvard professor to join McWeadon-Faith Bangladesh Webinar on e-learning

- Bangladeshi-American to be first South Asian Lt Commander in NYPD

- Maria Howlader made new Chair of SAFA Women Leadership Committee

- Intl Girls in ICT Day

Virtual roundtable on Accelerating Digital Inclusion for Girls held - JMI brings first Bangladeshi-branded KN95 masks

- Professor Zahir receives `Most Outstanding Professor’ Award

- C-BED Programme Launched in Bangladesh

- Foreign ministry issues 8-pnt statement over Rohingya relocation

- Vitol’s trades cause LNG prices soaring, BD affected

- Symphony launches new Smartphone Symphony Z30 Pro